The long-announced modernization of the fiscal cash register system in Poland will begin this year. It will include all existing “first generation” fiscal cash registers. Since there are many taxpayers, the replacement will be organized in stages and will last for few years. The final list and user specification has not been completed yet, it is certain that there will be new amendments even after the fiscalization begins. According to some comments due to the incompleteness of the law, there is a danger that same user has to replace the cash register twice. The main novelties on which the modernization is based are: e-receipts, online data transfer to the tax administration server, archiving of receipt data in digital form and unification of the protocol between cash register and the payment terminal.

The long-announced modernization of the fiscal cash register system in Poland will begin this year. It will include all existing “first generation” fiscal cash registers. Since there are many taxpayers, the replacement will be organized in stages and will last for few years. The final list and user specification has not been completed yet, it is certain that there will be new amendments even after the fiscalization begins. According to some comments due to the incompleteness of the law, there is a danger that same user has to replace the cash register twice. The main novelties on which the modernization is based are: e-receipts, online data transfer to the tax administration server, archiving of receipt data in digital form and unification of the protocol between cash register and the payment terminal.

Will Romania once again postpone the implementation of the Fiscal law annex (Ordinance 91/2014)? This week, National Council of Small and Medium Enterprises in Romania (CNIPMMR) filed a request to postpone the implementation foreseen for the period Jun-August 2018.

Will Romania once again postpone the implementation of the Fiscal law annex (Ordinance 91/2014)? This week, National Council of Small and Medium Enterprises in Romania (CNIPMMR) filed a request to postpone the implementation foreseen for the period Jun-August 2018.

The request states that the proposed solution in the annex has been technologically overcome. They also say that the tax administration has not renewed its resources for a long time and that ANAF IT center should be modernized before the fiscal reform. It is emphasized that it is necessary to digitize all of Romania, including rural areas. Previous attempts have been canceled due to inappropriate infrastructure. It is better, they say, to postpone the process for a year or two and thus introduce a modern solution.

Read More› Croatia has entered year five of fiscalization. Former Minister of Finance Mr. Slavko Linic, who was a great advocate of the fiscalization process in Croatia, confirmed on TV news last month that fiscalization was one of the most successful projects of the history of Croatian tax administration. Despite the strong resistance from certain groups of taxpayers, the project succeeded. This fiscalization, now known as the “Croatian model”, originally adopted from Latin experience of e-invoicing (NFC-e), has served the tax administrations of Slovenia and the Czech Republic to develop their fiscalization processes.

Croatia has entered year five of fiscalization. Former Minister of Finance Mr. Slavko Linic, who was a great advocate of the fiscalization process in Croatia, confirmed on TV news last month that fiscalization was one of the most successful projects of the history of Croatian tax administration. Despite the strong resistance from certain groups of taxpayers, the project succeeded. This fiscalization, now known as the “Croatian model”, originally adopted from Latin experience of e-invoicing (NFC-e), has served the tax administrations of Slovenia and the Czech Republic to develop their fiscalization processes.

Austrian Cash Register Security Regulation (RKSV) is currently in its second phase of implementation (phase one – 2016 obligation to have cash register, record transactions and issue receipts, phase two – 2017, the cash register must additionally be equipped with a technical security device).

Austrian Cash Register Security Regulation (RKSV) is currently in its second phase of implementation (phase one – 2016 obligation to have cash register, record transactions and issue receipts, phase two – 2017, the cash register must additionally be equipped with a technical security device).

Michael Engelbert, public manager in Austrian Ministry of Finance declared this month: ”Introduction of RKSV, started with outrages opposition, but after year and half merchants have settled, although they still say its a bad idea. We estimate that 85 percent of merchants already have a cash register and data security solution. Income is rising, currently very strong. Is it caused by economic growth or by reduction of the gray economy, it cannot be precisely determined. “

Financial police goes to routine checks examining if sellers are issuing genuine receipts. When inspector detects a violation of the law, he/she will report it to the financial administration and it will initiate the tax audit.

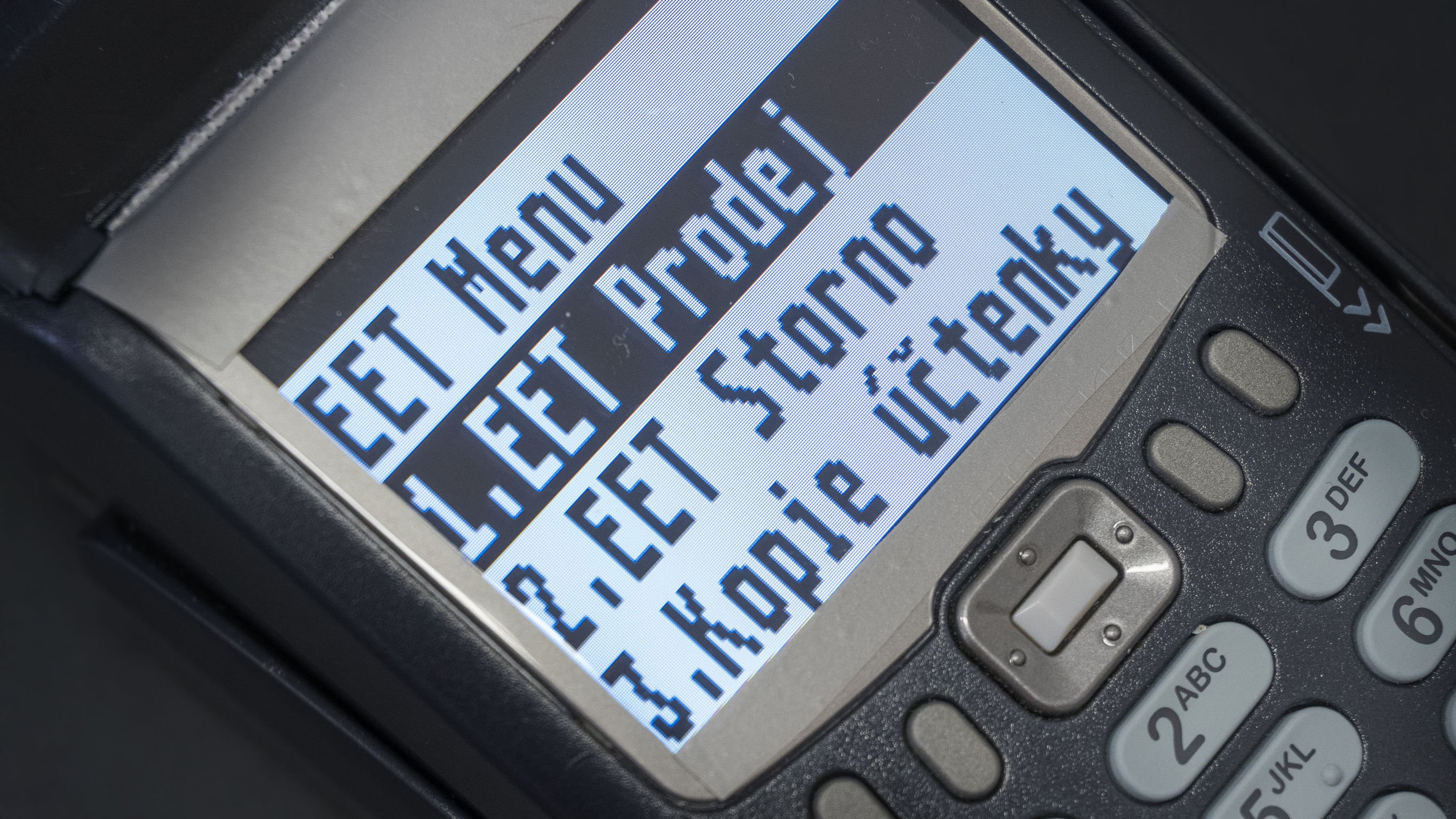

Read More›The Constitutional Court of the Czech Republic has reviewed the requirement on the constitutionality of the law on Electronic record of sales („zákon o EET”). The final decision of the court is that the law as a tool for regulating sales control is overall good. On the other hand, it has been concluded that there are some flaws in the law concerning the privacy of citizens and that attention must be paid to the content of the invoice that is a public document.

Read More›Fiji will soon join the growing number of countries that will start the fiscalization process, as of January 2018. Earlier in June this year, Regulation was officially published.

From January 1st 2018 all supermarkets and pharmacies will have to comply with the Regulation. Each sales point will be monitored by an EFD (Electronic Fiscal Device) that issues a digitally signed invoice and performs remote transfer to a dedicated tax administration server in Fiji. This invoice can be verified and stored on tax administration server in a digital form for an unlimited time.

The EFD under the Regulation must be accredited. Requirements for that are minimal and the time that developers have to fulfill in its adaptation is short, especially for the computerized POS developers. FRCS is inviting vendors to register and test their solutions with Tax Authority.

Read More› One month after Cash Register Ordinance Registrierkassensicherheitsverordnung (RKSV) commenced into force, some comments appeared to suggest that process at the beginning had more problems as it was probably expected. Start of the project was postponed, instead of starting the January 1 it started on April 1 since most users were not ready on January 1, they were given more time to prepare. First month of implementation resulted lower compliance from taxpayers than expected; there are those who still do not issue receipts, although they were obliged to do it even before the 1st of April. One of the leading software vendors in Austria (BMD) made an independent survey that included 239 taxpayers (from SME to corporates), and reveled that errors and malfunctions related to compliance with technical requirements were found in one-third. Almost 40% percent of the receipts were not correct. Percentage of defects is higher in the gastronomic sector than in the other industries.

One month after Cash Register Ordinance Registrierkassensicherheitsverordnung (RKSV) commenced into force, some comments appeared to suggest that process at the beginning had more problems as it was probably expected. Start of the project was postponed, instead of starting the January 1 it started on April 1 since most users were not ready on January 1, they were given more time to prepare. First month of implementation resulted lower compliance from taxpayers than expected; there are those who still do not issue receipts, although they were obliged to do it even before the 1st of April. One of the leading software vendors in Austria (BMD) made an independent survey that included 239 taxpayers (from SME to corporates), and reveled that errors and malfunctions related to compliance with technical requirements were found in one-third. Almost 40% percent of the receipts were not correct. Percentage of defects is higher in the gastronomic sector than in the other industries.

On January 18th 2017, Czech Finance Minister Andrej Babiš held a conference where he spoke about positive results of fiscalization in the Czech Republic. In the first month of system operation (December 2016), 43000 taxpayers issued over 118 million fiscal receipts. Those receipts are generated by the first group of taxpayers. Next group of 250,000 new taxpayers in retail sector is planned to rollout in March 2017.

On January 18th 2017, Czech Finance Minister Andrej Babiš held a conference where he spoke about positive results of fiscalization in the Czech Republic. In the first month of system operation (December 2016), 43000 taxpayers issued over 118 million fiscal receipts. Those receipts are generated by the first group of taxpayers. Next group of 250,000 new taxpayers in retail sector is planned to rollout in March 2017.

How to account for VAT in the circumstance when you offer a discount on condition that something happens later (for example, on condition that the customer buys more from you) or a customer fails to pay full amount based on the instalment that previously agreed upon?

Read More›World is entering a very turbulent period where economies are becoming dependent on proper fiscalization. Many countries in 2016 has started implementation processes related to changes of the existing or defining new fiscal laws and regulations, launching tenders for the procurement of necessary HW and SW for fiscal solutions and finally in some countries successful fiscalization has generated new revenues.

The upcoming year (2017) will remain very colorful, in terms of different views of what is the best fiscalization method. Many countries have already voted new legislations or are just now preparing for it. The goal is common, combatting the black economy, mostly in cash-based sectors. Following is a quick recap of events that are ongoing in some fiscal countries:

Read More›